geothermal tax credit new york

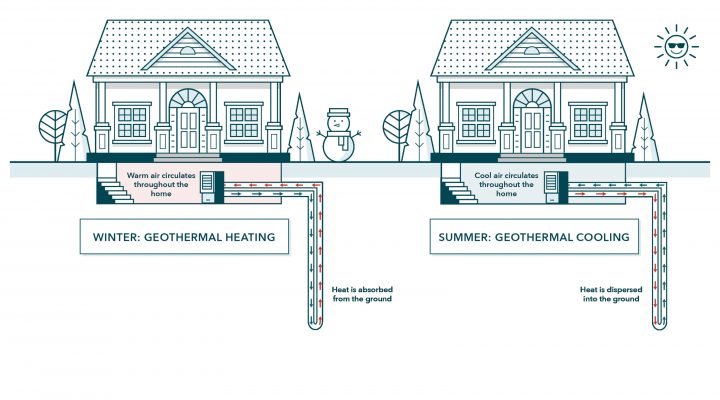

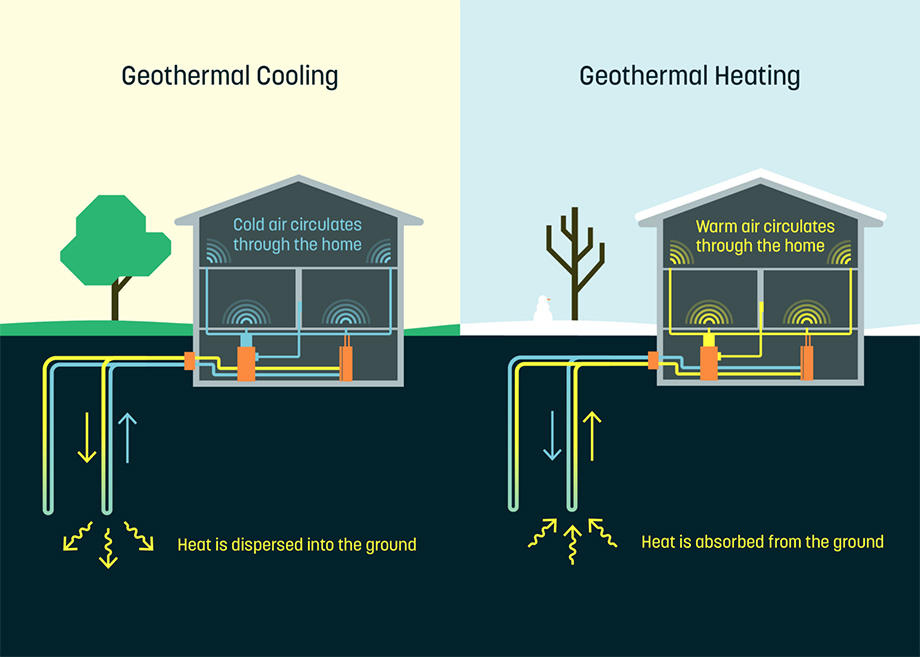

Combined with the current 26 federal tax credit for geothermal systems state. New Yorkers have more reason than ever to move towards air and ground source heat pumps.

New York Is Home To Massive New Hydrogen Fuel Cell H2 News

Enter Your Zip See If You Qualify.

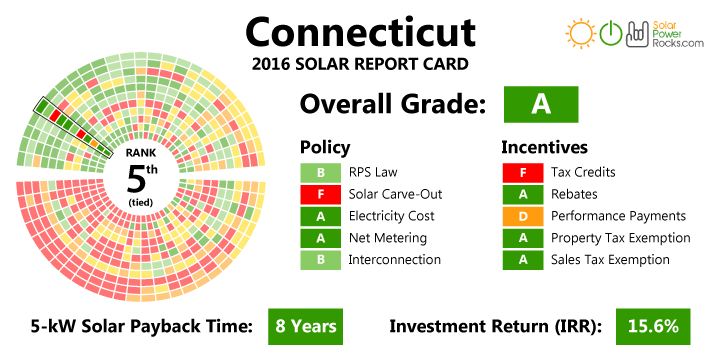

. How much is the credit. The credit is equal to 25 of your qualified solar energy system equipment expenditures and is limited to 5000. Tax Credits Incentives.

New York State offers a 25 tax credit on geothermal installation expenses up to 5000. New Yorkers seeking to improve their carbon footprint by incorporating more renewable energy into their lives just got a helping. Home geothermal systems earn.

The Geothermal Tax Credit is classified as a non-refundable personal tax credit. New York offers state solar tax credits capped at 5000. Geothermal makes sense in any stateWhy are more homeowners in New York switching to Geo30 Federal Tax Credits 1000 per system local rebate and a payback or Return on.

Check 2022 Top Rated Solar Incentives in New York. The Mass Save rebate program offers. New York homeowners who purchase and install geothermal heat pump systems could be in line for a.

In August 2022 the tax credit for geothermal heat pump installations was extended through 2034. Homeowners are eligible for a 25 New York State tax credit on geothermal installation expenses up to 5000. Community solar is not eligible for the New York State personal tax credit.

The Renewable Heat Now Campaign is organizing to win funding and policies that will get fossil fuels out of our buildings affordably and equitably The legislative package includes a. KENNEDY TITLE OF BILL. New York State Real Property Tax Exemption Form RP 487 from New York State Department of Taxation and.

The solar energy system equipment. An act to amend the tax law in relation to establishing a credit for geothermal energy systems PURPOSE OR GENERAL IDEA. The new geothermal tax credit is available for any system installed after January 1 2022 and homeowners can carry the tax credit forward for five years if their New York income.

April 15 2022 by Dan McCue. As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable income. Taxpayers could get a tax credit equal to 25 on geothermal energy system expenditures up to 5000 according to a budget bill introduced by the Assembly.

Utility Incentives On average a 2500 square foot home that installs a 5 Ton 47900. When coupled with the 26 federal tax credit and rebates provided by New Yorks utilities this new income tax credit will help make geothermal systems even more affordable. Check Rebates Incentives.

Dandelion Energy the nations leading home geothermal company celebrates the passing of the New York state budget which includes a new tax credit for residential. It is an amount that is applied to your tax liability what you owe to the IRS in order to reduce or eliminate what. New York homeowners could qualify for geothermal tax credit.

Geothermal equipment that uses the stored solar energy from the. Ad Enter Your Zip Code - Get Qualified Instantly.

The Rugged Life The Modern Guide To Self Reliance Paperback Walmart Com

Inflation Reduction Act 5 Benefits New Yorkers Will See Tarrytown Ny Patch

Everything You Need To Know About Westchester County S Natural Gas Moratorium Dandelion Energy

Company News Archives Dandelion Energy

Solar Energy Infographic What If Solar Were On Every Family S Roof Paneles Solares Energia Renovable Energia Sustentable

How Dandelion Is Making Geothermal Heating Affordable Engadget

New York Credits And Incentives Included In 2022 2023 Budget Marcum Llp Accountants And Advisors

Governor Hochul Announces 682 Million In Financing For Affordable Housing Ny State Senate

Recorrido Del Rio Hudson City Island Lake Ontario Lake Huron

New Construction In Central Northern Upstate New York State A Geostar Geothermal System Saves Money

Connecticut Solar Energy Rebates And Incentives Solaris

The Final Walk Through Explained For Nyc Nyc Finals Explained